These logbooks outline the key milestones of projects led by the Coop. We share our successes, our setbacks, and our lingering questions. Think of it as ongoing documentation—imperfect and ever-evolving. This particular edition focuses on our mobilization and co-construction methods for the territorial financing vehicle project; it only touches on the surface of the operational details, which will be the subject of a dedicated logbook in the coming weeks. Enjoy the read! 😊

For nearly a year, we have been working on setting up a territorial financing vehicle designed to mobilize various types of funding in a complementary way (public and private investment, grants, philanthropy, and community-led savings). This initiative supports a collective resilience strategy for the Orne watershed (where water management seals the solidarity between the upstream and downstream areas).

This project is part of a partnership (The Resilience Partnership) between the Bioregional Weaving Lab Collective (BWLC), the Wire Group, and our Colina cooperation hub. Over the past few months, we have begun opening the discussion to other stakeholders—investors, institutions, local authorities, and community actors—with the intent of challenging our hypotheses, mobilizing the technical expertise we lack, and broadening this collective reflection.

Last week marked a turning point in this outreach process. We gathered investors, regional projects, and local authorities in the Orne region for three days to share perspectives on this project. These gatherings serve three vital functions in building this type of project: (i) gaining a better understanding of the needs we are trying to address; (ii) fostering encounters and building human bonds and relationships of trust; and (iii) encouraging collective ownership of the vision and the project. Here is the story!

1/ Understanding the need

For nearly three months, Colina has been conducting diagnostics with its members to better understand their financing needs and the various types of constraints our organizations may face (human resources, management, etc.). These diagnostics highlight different types of needs in terms of investment, grants, and cash flow. However, by digging deeper into these discussions during these three days of exchange and seeking the "need behind the need," we identified four major challenges that had not clearly emerged in our preliminary discussions.

1. Rethinking the funder-fundee relationship: unsurprisingly, an asymmetrical relationship exists between the capital holder and the person who needs it to develop their activity. This asymmetry creates relational dynamics that are undesirable for any cooperation. The project leader's needs: (i) funders who understand their project (objectives, needs, and constraints), aligned with the core intention (transforming our production models, governance, etc.) and willing to act as a resource person (transfer of technical expertise, adaptation to the unforeseen events of complex projects, etc.); and (ii) diversified access to capital/funding to rebalance the relational asymmetry.

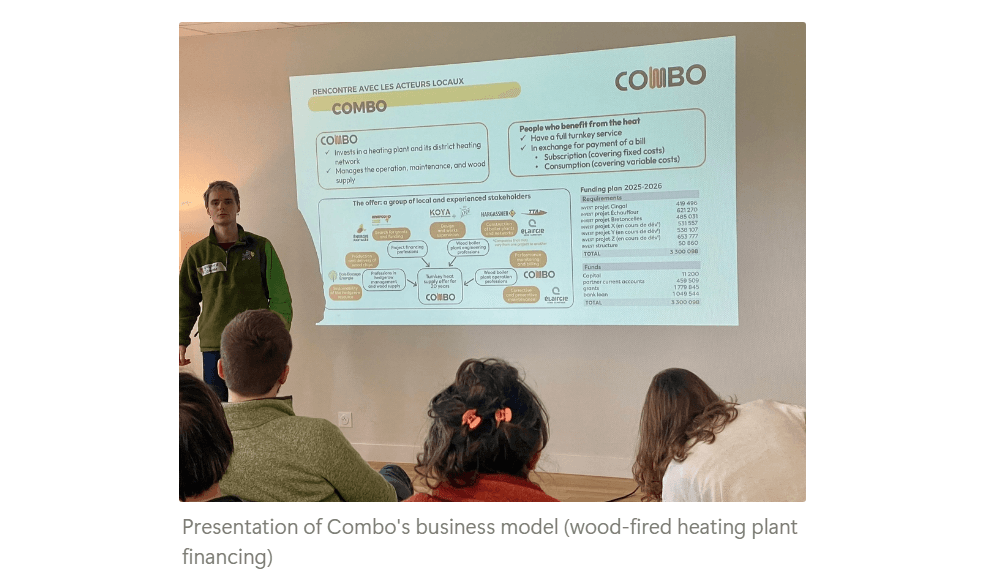

2. Delegating financial engineering: our small organizations (fewer than 10 employees) develop specialized professional expertise (wood-energy, recycling, agricultural installation, etc.). Yet, to offer this professional expertise, the project leader must also develop sharp financial expertise to: (i) design the financial modeling of their project; (ii) develop relationships with their funders; (iii) translate their needs into a language understandable by funders; and (iv) ensure administrative and budgetary monitoring. However, developing this expertise comes at the expense of their core professional expertise (one project leader reported spending 50% of their time on budgetary planning). The need: access to a person dedicated to financial engineering (via a shared position), understanding both the needs/constraints of the project and those of the funders (public, private, philanthropic, etc.) and capable of acting as a bridge between these different worlds.

3. Switching from project finance to organizational finance: following on from the previous point, a striking observation is the exhaustion generated by project-based funding logic. For most of our organizations, the project leader is usually forced to build a complete financial case for every new operational step. This fragmentation keeps the entrepreneur in a state of perpetual fundraising, turning their activity into a succession of individual projects to be financed one by one. This considerably hinders scaling up and team stability. The need: a financial architecture designed to foster project continuity and the scaling of organizations.

4. Valuing ecosystem returns: most of our projects face a major difficulty—the economic impact of their actions is observed over the long term and at a scale that is not solely attributable to their individual projects. For example, planting hedges upstream in a watershed reduces flood risks downstream. After 20 years, the economic impact of concerted action around hedges is considerable (for local authorities, the State, the insurance sector, and residents). However, these economic effects are never remunerated in the business models of these actors, who therefore lose part of the economic value created over the long term. The need: a financial architecture (and thus an incentive system) that allows for tracking, measuring, and valuing the economic impact of these activities. The vehicle could thus serve as a laboratory to learn how to measure these values that the current market ignores.

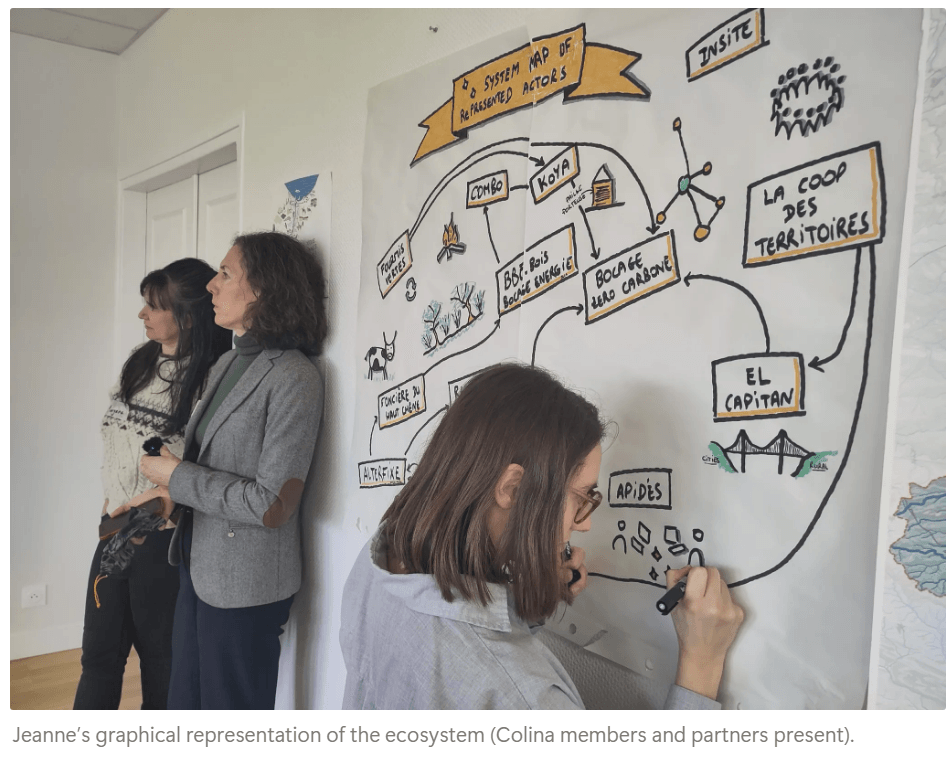

One concept cuts across these four needs: that of the ecosystem. The diversification of funders, shared financial engineering, scaling up, and the valuation of ecosystem returns all depend on structuring an ecosystem of actors organized to respond collectively to each of these needs. Other needs intersect with these various challenges (cost of capital, risk sharing, etc.) and would deserve their own analysis—but they are each linked in one way or another to one or more of these four challenges

This panoramic view emerged by crossing a multitude of discussions held during project visits, our design workshops, and our informal discussions. It is the diversity of viewpoints and exchange contexts that allowed for a form of collective alignment around this structural question for the future of the project: which needs do we truly want to address?

2/ Building trust

The "cement" of any cooperative project. By its very nature, trust cannot be mandated; it is woven over time through evolving relationships and shared experiences. It can also be seen as a form of capital necessary for the project's successful development. This capital can grow, or it can erode. In any case, it must be managed carefully, like a precious resource.

So why is it so important? The answer seems so obvious, and yet. It is central on at least three levels:

- First, it reduces transaction costs between the various stakeholders (e.g., reducing reporting requirements between fundees and funders, shortening negotiation times, etc.) while accelerating the project's pace.

- Next, it creates a context where risk-taking (and thus innovation) is more encouraged to imagine new solutions (the fear of judgment is reduced, and measured risk-taking is better understood and valued).

- Finally, it makes human interactions more fluid, exciting, and energizing, but also more sincere and demanding (knowing how to be honest with one another). Feeling a human connection with partners encourages transparency and long-term commitment.

Make no mistake: in a territorial financing vehicle, trust should not be seen as a mere “added soul”. It is a risk management tool. Where traditional finance manages uncertainty through a multiplication of external audits and costly contractual guarantees, we aim to manage it through the quality of the bond and an intimate knowledge of the projects. This is what allows an “invisible risk” for a distant bank to be transformed into a “managed risk” by a local collective. A clear advantage for funders: better risk management, coupled with access to high-quality projects that are difficult to identify from outside the territory.

Now, how do we build this trust? In short, by creating the conditions that allow the various people involved to discover each other, to understand one another, to grasp what brings them together, and to become aware of their differences and complementarities. Creating these conditions can take many forms, but they will mostly rely on a few key foundations.

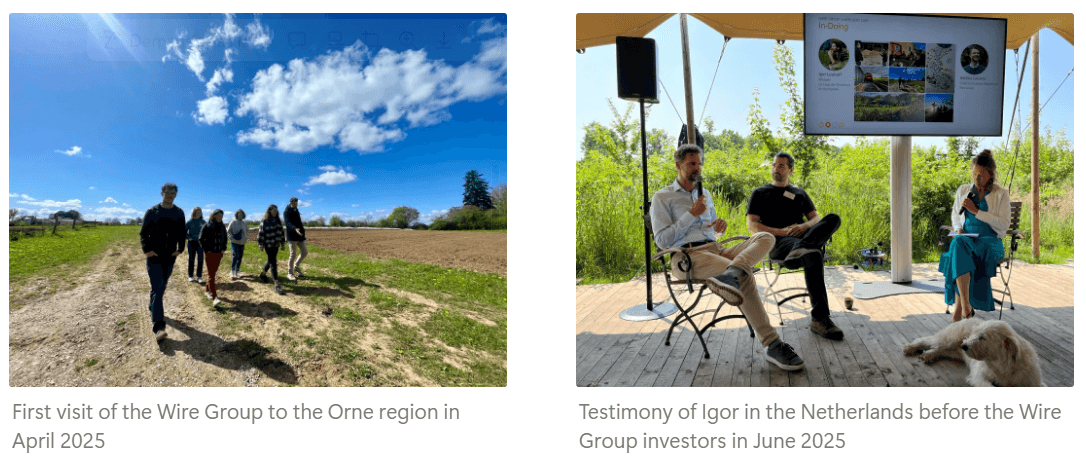

1. Face-to-face interaction: in our digitized society, moments shared in person have taken on a new value. We coordinate remotely, but we truly connect (and reconnect) in person. This is something that struck us when we first met the BWLC and Wire Group teams. Before committing to any partnership or signing any document or agreement, Karin, Noa, and Michiel all spent several days in the Orne region. They came to get to know us, understand our context, and meet the projects and institutional stakeholders. This latest meeting marked their third visit in less than a year.

2. Spaces for conviviality: we can meet in person, but the exchanges and outcomes will differ depending on whether we are in a formal institutional setting or in more personalized spaces. In our case, using our shared inn, El Capitan, greatly facilitates this atmosphere and the logistics of these gatherings. Whether it’s for hosting guests, organizing a casual drink, or a relaxed meeting, the venue is perfectly suited for the task. Combined with a few rooms at the Hôtel Sophie and the shared space at Apidés in Briouze, El Cap can fully play its role as a base camp and a hub for conviviality.

3. Intimate spaces: we don't share the same things at a large gathering of twenty people as we do in a small circle by the fireside. These spaces are essential for truly understanding what brings people together—who we are behind our professional titles, and what our deeper motivations and intentions are.

4. Continuity and the long term: all these moments have value when taken separately or in isolation. However, their true value is revealed over time. It is the gradual progression of relationships, the rhythm of meetings, the rituals maintained over the long haul, and the diversity of contexts for meeting and collaborating that allow this trust to be woven. In short, for us, trust represents a core component of cooperation engineering, just as vital as a solid budget or a high-quality project team.

3/ Building together

And what is all this for? To be able to build something that makes sense for everyone involved. Collective construction is an iterative process. We move from an individual intuition to a collective intention. We transition from a blurry but intriguing image to a photograph where individual pixels fade away in favor of a clear, coherent, and unifying whole. For now, we are still at the stage of the blurry but intriguing image. We are trying to ask the right questions and mobilize the right people to help us find potential answers. We are forming a circle that expands and diversifies as we move forward.

In February 2025, the initial circle was composed of the Resilience Partnership team members (Karin Muller from the BWLC, Michiel Lenstra and Hadewych de Groot van Embden from the Wire Group, and Igor Louboff from the Coop des territoires—later joined by Jeanne Allard from Colina). This first circle established the starting intuition, cleared the ground, and mobilized stakeholders. Put simply: Karin mobilizes philanthropic funds to finance the project’s engineering (the R&D phase), Michiel and Hadewych mobilize impact investors to build the initial fund, and Jeanne and Igor mobilize Colina members and local actors to understand the needs and design the vehicle's framework.

In September, a meeting was organized by the Coop des territoires and Makesense (Sylvia Garzon) to bring together a diverse range of funders and present the project's vision. Following this meeting, a Sounding Board (Strategic Council) was created to gather experts from the financial world to support us in the vehicle's design. Today, the Sounding Board consists of Karin (BWLC), Michiel (Wire Group), Igor (Coop des territoires/Colina), Franck Murray (Normandie Participations), Anne Gerset (Makesense), and Iyas Ben (PSBL Finance).

In October, a diagnostic methodology was designed by the Colina team to assess the financial needs (amounts and nature) of its members and their capacity to manage new fund injections (human resources, governance, etc.). To date, 3 diagnostics have been completed across the 6 member organizations.

In November, a working group was launched within Colina to lay the foundations for the vehicle: investment thesis, governance, economic modeling, fundraising, selection criteria for financed projects, etc. This group is composed of representatives from member organizations wishing to design a tool serving both their organizations and their territory.

This February 2026 meeting marks a new stage in expanding the circle. By bringing together investors and local authorities, we are striving to integrate their respective readings of the project, their understanding of the needs, and the constraints (regulatory, financial, legal, etc.). Our request: 'challenge our hypotheses.' Are we targeting the right needs? Is the envisioned legal structure legal? What are the risks of a significant capital injection into an ecosystem of actors that is still being built? etc.

This iterative process of intuition, reflection, and continuous questioning enables two fundamental outcomes: (i) a progressive ownership of the project by a diverse collective (local actors, technical experts, and funders) that we aim to keep expanding; and (ii) a design that integrates and strives to align viewpoints and frameworks that often seem contradictory—at least at first glance. The result of this process? The emergence of creative solutions. By crossing these different perspectives, we can imagine configurations that simply did not exist before.

For those who are more curious, our core intuition is the creation of a hybrid structure linking an endowment fund (fonds de dotation for philanthropy and de-risking) and an investment vehicle (a SAS or SCIC for private capital) in order to mobilize blended finance.

4/ Next steps

Looking ahead, we have identified the following next steps:

- Expanding the Sounding Board: we aim to include an additional foundation profile and another investor profile to ensure a comprehensive panel representing the different types of funders we wish to mobilize through this vehicle.

- Fundraising for project engineering: the resources currently available to jumpstart this project remain limited. To move forward, we need to strengthen the team by recruiting a dedicated person (a finance generalist familiar with investment, philanthropy, and the social and solidarity economy) and by mobilizing targeted technical expertise (lawyers, tax specialists, etc.).

- Financial and legal modeling: the goal now is to move from intuition to an operational model by precisely structuring the hybrid vehicle (the link between the endowment fund and the investment company—SAS or SCIC—investment committee composition, governance, etc.). This modeling work will validate the feasibility of "de-risking" (using philanthropy as first-loss capital) and define the mechanisms for capital flow between the different structures. The objective is to produce a global business plan to test our hypotheses regarding returns, risk, and ecosystemic impact.

- Identifying academic partners: this initiative deserves to be both informed and monitored by the academic world. A potential lead at the CNRS has been identified and will soon be explored.

The challenge over the coming months is to transform these collective reflections into a solid architecture (which will be presented in a future logbook addressing the many underlying operational questions). If you feel you have pieces of this great puzzle to share—whether through a question, critical feedback, a suggestion, or an introduction—please do not hesitate to contact us directly.

Finally, if you would like more details about this meeting, you can take a look at this documentation page, where you will find the video of the meeting, photos, and more.

Written by: Igor Louboff

Want to follow our next logbooks? You can subscribe to our newsletter 😊